Notional Finance is a decentralized finance (DeFi) protocol that offers a unique combination of high yield, low volatility, and ease of use. The platform is built on the Ethereum blockchain and uses smart contracts to automate the process of lending, borrowing, and investing. Notional Finance’s liquidity pool mechanism, dynamic collateral management system, and user-friendly interface make it a leading innovator in the DeFi space. Its growing adoption and partnerships suggest that it has a bright future.

Introduction:

The decentralized finance (DeFi) ecosystem has been growing rapidly, with new protocols and platforms emerging daily. One of the most promising and innovative of these is Notional Finance. In this blog post, we will explore Notional Finance, how it works, and why it will likely become a game-changer in the DeFi space.

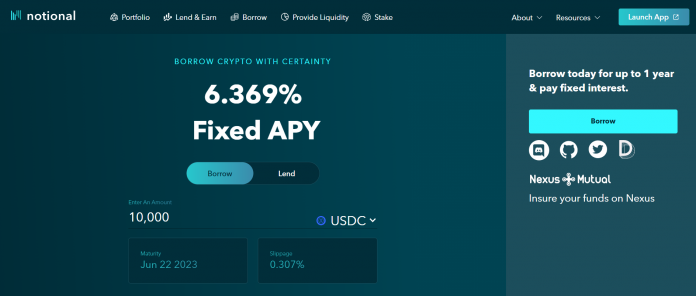

As the DeFi industry continues to evolve and mature, new protocols and platforms are emerging that are offering new and innovative solutions to the challenges faced by traditional Finance. One such platform is Notional Finance, a decentralized finance (DeFi) protocol poised to revolutionize how we think about decentralized Finance. Notional Finance combines the best of traditional Finance and DeFi to offer users a unique and cutting-edge platform that delivers high yield, low volatility, and ease of use.

This blog post will delve into Notional Finance, exploring what makes it different from other DeFi protocols. We will examine the key features and benefits of Notional Finance, including its unique liquidity pool mechanism, its dynamic collateral management system, and its user-friendly interface. We will also look at real-world use cases and partnerships that demonstrate the growing adoption of Notional Finance and discuss the challenges and risks the protocol faces and how it addresses them.

Whether you’re a seasoned DeFi veteran or just starting to explore the world of decentralized Finance, this blog post will provide a comprehensive understanding of Notional Finance and why it is worth watching. So, buckle up and get ready to explore the exciting world of Notional Finance, the innovative DeFi protocol that is changing the game.

What is Notional Finance?

Notional Finance is a decentralized finance (DeFi) protocol that offers a unique and innovative solution to the challenges faced by traditional finance. It combines the best of both worlds, combining the security and stability of traditional finance with the accessibility and transparency of DeFi. Notional Finance is built on the Ethereum blockchain, making it a decentralized and trustless platform that operates globally.

Notional Finance in the DeFi Ecosystem Notional Finance is part of the rapidly growing DeFi ecosystem, revolutionizing our thoughts on finance and investment. The DeFi industry has seen explosive growth recently, with new protocols and platforms emerging daily. Notional Finance stands out from the crowd by offering a unique combination of high yield, low volatility, and ease of use, making it a leading innovator in the DeFi space.

Overview of Key Features and Benefits

- Liquidity Pool Mechanism: Notional Finance offers users a unique liquidity pool mechanism that delivers high yield to depositors. This mechanism maximizes returns while minimizing risk, making it an attractive option for earning passive income.

- Dynamic Collateral Management System: Notional Finance’s dynamic collateral management system helps reduce risk and volatility, making it a more stable investment option than other DeFi protocols.

- User-Friendly Interface: Notional Finance’s user-friendly interface makes it accessible and easy for non-technical users, lowering barriers to entry and increasing accessibility.

Competitors of Notional Finance

Notional Finance faces competition from other DeFi protocols, including Aave, Compound, and Curve. However, Notional Finance differentiates itself from these competitors through its unique liquidity pool mechanism, dynamic collateral management system, and user-friendly interface. These advantages give Notional Finance a competitive edge in the DeFi space and position it as a leading innovator.

How Does Notional Finance Work?

Notional Finance is built on the Ethereum blockchain, using smart contracts to automate the process of lending, borrowing, and investing. This decentralized and trustless architecture ensures that all transactions are secure, transparent, and immutable.

Components and Modules of the Protocol

- Token: Notional Finance has its own native token, NOTL, which is the protocol’s backbone. NOTL is the token used for governance, liquidity provision, and loan collateral.

- Governance: Notional Finance has a decentralized governance model, allowing token holders to participate in the decision-making process and influence the direction of the protocol.

- Liquidity Pools: Notional Finance’s liquidity pools are at the heart of the protocol, allowing depositors to earn passive income by providing liquidity to the pools. The liquidity pools will maximize returns while minimizing risk, making them an attractive option for those looking to earn passive income.

Notional Finance is a complex and innovative protocol that combines the best of traditional Finance and DeFi to deliver high yield, low volatility, and ease of use. Its decentralized and trustless architecture, user-friendly interface, and innovative features make it a leading player in the DeFi space and a force to be reckoned with in the world of decentralized Finance.

The Benefits of Notional Finance:

- Increased Yield for Depositors:

Notional Finance’s unique liquidity pool mechanism delivers increased yield to depositors, making it an attractive option for those seeking passive income. By providing liquidity to the pools, depositors can earn a share of the interest generated by the loans funded by the pools. This innovative mechanism allows Notional Finance to deliver high yields to depositors, making it a competitive option in the DeFi space.

- Lower Volatility and Reduced Risk:

Notional Finance’s dynamic collateral management system helps to reduce volatility and risk for depositors. This system uses a combination of over-collateralization and dynamic collateral ratios to ensure that loans are always fully collateralized, reducing the risk of defaults and minimizing the potential for losses. This feature helps to stabilize the protocol and make it a more attractive investment option for those looking to diversify their portfolios.

- Increased Accessibility and Ease of Use:

Notional Finance’s user-friendly interface and low barriers to entry make it an accessible and easy-to-use platform for non-technical users. The platform is user-friendly and intuitive, with a straightforward interface that makes it easy for new users to get started. This feature of increased accessibility and ease of use makes Notional Finance an attractive option for those new to the DeFi space or looking for a more user-friendly investment option.

Notional Finance offers a range of benefits to users, including increased yield, lower volatility, reduced risk, and increased accessibility and ease of use. These benefits, combined with its innovative features and cutting-edge technology, make Notional Finance a leading player in the DeFi space and a promising investment option for those looking to diversify their portfolios.

Real-world Use Cases and Adoption:

- Use Cases and Partnerships:

Notional Finance has successfully established partnerships and real-world use cases that demonstrate the growing adoption of the protocol. For example, Notional Finance has partnered with leading DeFi projects such as Uniswap and Aave to integrate its liquidity pools and increase its reach in the DeFi ecosystem. Additionally, Notional Finance has been used in several successful yield farming campaigns, demonstrating its popularity and growing adoption in the DeFi space.

- Growing Adoption and Potential Impact:

The growing adoption of Notional Finance is a testament to its unique combination of high yield, low volatility, and ease of use. As more users discover the benefits of Notional Finance, its popularity will likely grow, positioning it as a leading player in the DeFi space. The potential impact of Notional Finance on the future of DeFi is significant, as it has the potential to revolutionize the way we think about decentralized Finance and investment.

The real-world use cases and partnerships of Notional Finance and its growing adoption demonstrate its potential to become a leading player in the DeFi space. The future of Notional Finance is bright, and its impact on the DeFi ecosystem will be significant. Whether you’re a seasoned DeFi veteran or just starting to explore the world of decentralized Finance, it’s worth keeping an eye on Notional Finance and its potential to shape the future of DeFi.

Challenges and Risks:

- Overview of Potential Risks :

As with any new and innovative technology, Notional Finance faces several challenges, including regulatory, liquidity, and technical risks. Regulatory risks are a concern as the DeFi industry is still largely unregulated, and there is a risk that governments may take action to restrict or ban DeFi platforms in the future. Liquidity risks are also a concern, as fluctuations in the market can impact the value of the assets in the liquidity pools, potentially leading to losses for depositors. Technical risks include the risk of bugs or vulnerabilities in the code, which could compromise the platform’s security and lead to losses for users.

- Measures to Mitigate Risks:

Notional Finance is taking steps to mitigate these risks and ensure the stability and security of its platform. For example, the protocol has implemented strict security measures to protect against technical threats, including regular audits and bug bounties to identify and fix vulnerabilities. Additionally, the platform has established robust risk management systems to minimize the impact of market fluctuations on the liquidity pools and reduce the risk of losses for depositors.

While there are certainly challenges and risks associated with Notional Finance, the platform is taking steps to mitigate these risks and ensure the stability and security of its platform. The measures taken by Notional Finance to address these risks are a testament to its commitment to delivering a secure and stable platform to its users and demonstrate its potential to become a leading player in the DeFi space.

Conclusion:

We have looked at the key features and benefits of Notional Finance, including its liquidity pool mechanism, dynamic collateral management system, and user-friendly interface. We have also discussed its real-world use cases and partnerships, growing adoption, and the measures taken to mitigate the challenges and risks faced by the protocol.

With its high yield, low volatility, and ease of use, Notional Finance is well-positioned to become a significant player in the DeFi ecosystem. The growing adoption of Notional Finance is a testament to its potential to revolutionize the DeFi space and its place as a leading innovator in the industry.

In conclusion, Notional Finance is a promising and innovative DeFi protocol that has the potential to shape the future of decentralized Finance. Whether you’re a seasoned DeFi veteran or just starting to explore the world of DeFi, it’s worth watching Notional Finance and its potential to revolutionize the DeFi space.